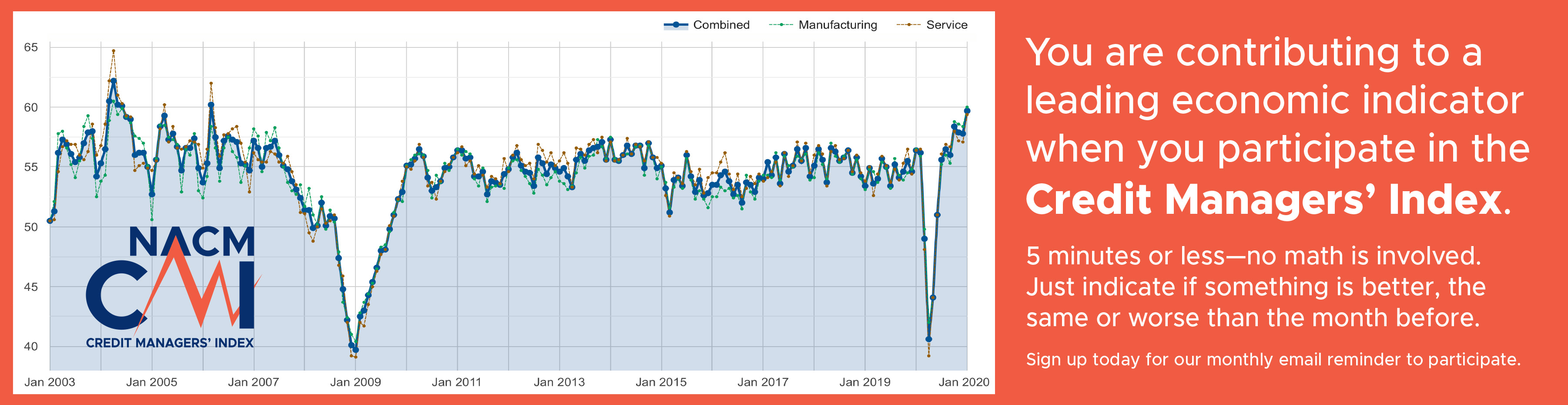

May’s economic report from the National Association of Credit Management shows slight growth, with the combined index increasing from 53.9 last month to 54.1.

The May report of the Credit Managers’ Index (CMI) from the National Association of Credit Management (NACM) reflected a small increase this month. May’s combined index is back to 54.1, the same reading as recorded in February. While the reading is certainly respectable, most of last year saw a higher combined score—in the 56 range.

“The word of the day seems to be ‘incremental,’” said NACM Economist Chris Kuehl, Ph.D. “There are still signs of growth and some stability. The problem is that there was an expectation of more by this time.”

The CMI index of favorable factors declined from 59.8 in April to 58.8 this month, and the index of unfavorable factors are at 50.9— just above the contraction zone. The good news, however, is the overall index is not as low as the 53.4 reading posted in March. The biggest drop this month in the combined sectors came in the sales category, slipping from 59.1 to 57.1—the lowest it has been in the last two years. “This suggests that there remains a lot of caution among consumers and business buyers alike—something that has been reinforced by the durable goods data of late,” said Kuehl.

In the index of unfavorable factors, accounts placed for collection and dollar amount beyond terms both exited the 40s and got back into the expansion zone.

“The year-over-year trend is slightly off and is closer to the contraction zone than it has been,” said Kuehl. “There is no imminent danger of sliding under 50 anytime soon, but by the same token there will be little flirting with the 60s either.”

For a full breakdown of the manufacturing and service sector data and graphics, view the complete May 2015 report at http://web.nacm.org/CMI/PDF/CMIcurrent.pdf. CMI archives may also be viewed on NACM’s website at http://www.nacm.org/cmi/cmi-archive.html.

ABOUT THE NATIONAL ASSOCIATION OF CREDIT MANAGEMENT

NACM, headquartered in Columbia, Maryland, supports more than 15,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of affiliated associations are the leading resource for credit and financial management information, education, products and services designed to improve the management of business credit and accounts receivable. NACM’s collective voice has influenced federal legislative policy results concerning commercial business and trade credit to our nation’s policy makers for more than 100 years, and continues to play an active part in legislative issues pertaining to business credit and corporate bankruptcy. NACM's annual Credit Congress & Exposition conference is the largest gathering of credit professionals in the world.

Contact: Diana Mota, Associate Editor, 410-740-5560, This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.nacm.org

Source: National Association of Credit Management